Can the Correlation Coefficient Really Predict Stock Market Success?

Sep 29, 2024 By Aldrich Acheson

Advertisement

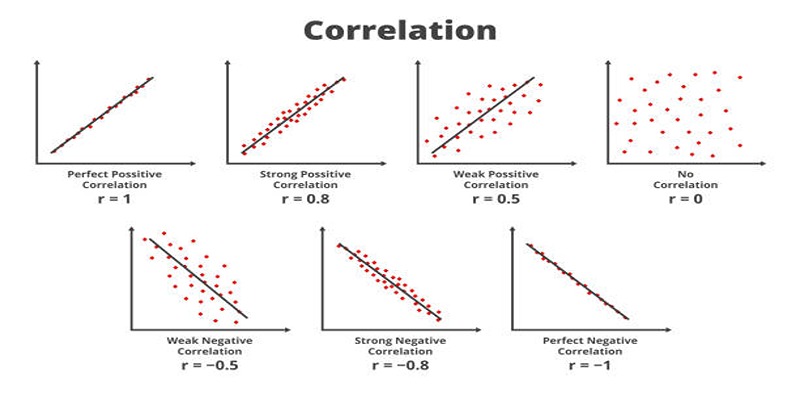

Predicting success in the stock market is a complex endeavor that often necessitates a variety of statistical tools and metrics. Among these, the correlation coefficient serves as a crucial indicator for investors evaluating the strength and direction of relationships among different market variables. Essentially, this coefficient quantifies how closely two data sets move in relation to each other, with values ranging from -1 to 1. A positive correlation suggests that as one variable increases, the other tends to increase as well, while a negative correlation indicates an inverse relationship. However, the stock market's inherently volatile nature and the myriad of influencing factors can complicate the reliability of correlation coefficients on their own. This raises important questions about their true capacity to accurately predict market trends.

What is the Correlation Coefficient?

The correlation coefficient is a statistical measure that quantifies the degree to which two variables are related. It is a crucial component in the field of statistics and finance, used extensively for assessing the strength and direction of relationships between different data sets. The value of the correlation coefficient ranges from -1 to 1. A value closer to 1 signifies a strong positive correlation, indicating that as one variable increases, the other tends to increase in a similar manner. Conversely, a value near -1 points to a strong negative correlation, implying that one variable tends to decrease as the other increases.

A coefficient close to 0 suggests no linear relationship between the variables. Understanding the nuances of the correlation coefficient is vital for investors and analysts, especially when attempting to draw insights or make predictions based on financial data.

Assessing Predictive Power

While the correlation coefficient offers valuable insights into the relationships between variables, its predictive power in terms of stock market success is limited. Investors should be cautious not to overestimate its capabilities, as correlation does not imply causation. A high correlation between two stocks may suggest a predictable pattern in historical data, but it does not account for external factors such as sudden economic changes, geopolitical events, or company-specific news.

Moreover, correlation coefficients can fluctuate over time, reflecting shifting market dynamics that may not be immediately apparent. Thus, while a useful tool in the analyst's arsenal, the correlation coefficient should be used in conjunction with other analytical methods and models that consider a broader spectrum of market influences.

Limitations of Correlation Coefficient in Predicting Stock Market Success

- Non-Causative Nature: The primary limitation of using correlation coefficients is that they measure association, not causation. Even a high correlation does not guarantee that changes in one variable cause changes in another, especially in complex systems like stock markets.

- Lack of Contextual Insight: Correlation coefficients do not account for the qualitative factors or events that can significantly impact market behavior, such as economic policies, technological advancements, or political unrest.

- Over-Reliance on Historical Data: These coefficients are often based on historical data, which may not accurately reflect future trends or sudden shifts in market conditions. Past correlations can become irrelevant as new factors emerge.

- Sensitivity to Outliers: The presence of outliers can skew correlation coefficients, misleading analysts about the true strength of a relationship. Such anomalies can be more common in financial markets due to sporadic spikes or drops.

- Linear Relationship Bias: The correlation coefficient assumes a linear relationship, which might not be the case between certain financial variables. Non-linear interactions require more complex models to capture accurately.

Investors should remain aware of these limitations and employ a multifaceted approach when predicting stock market trends, incorporating a variety of analytical tools and methodologies.

Alternative Factors in Stock Market Prediction

While the correlation coefficient provides one avenue for analysis, a comprehensive approach to stock market prediction considers a variety of additional factors. Understanding these alternative factors is crucial for forming a more holistic view of market dynamics:

- Economic Indicators: Metrics such as GDP growth rates, unemployment figures, and inflation rates offer insights into the broader economic environment in which markets operate. Well-performing economies tend to boost investor confidence, leading to potential market gains, whereas economic downturns can have the opposite effect.

- Monetary Policy: Central banks have a significant influence on financial markets through their monetary policy decisions, including interest rate adjustments and quantitative easing measures. Changes in interest rates can influence borrowing costs and money supply, which in turn affect investor behavior and asset prices.

- Market Sentiment: Investor sentiment, often influenced by news, social media, and market trends, can drive significant market movements. Indicators such as the Fear and Greed Index provide insight into whether investors are behaving optimistically or pessimistically, potentially signaling upcoming shifts in market momentum.

- Technological Advancements: Innovations and disruptions across industries can create new opportunities or threats for companies, impacting their stock performance. Companies that adapt rapidly to technological changes often gain competitive advantages, leading to increased investor interest.

- Global Events: Geopolitical events, such as trade tensions, conflicts, or international agreements, can have immediate and profound impacts on markets. These events can lead to shifts in capital flow, affect commodity prices, and create uncertainty or stability, influencing investor decisions.

- Company-Specific Factors: Internal factors such as leadership changes, earnings reports, and strategic developments play a pivotal role in determining a company's stock performance. Even with positive correlation coefficients, unforeseen company-specific issues can lead to deviations from expected trends.

Potential for Future Research and Use:

As financial markets continue to evolve, so too will the methods and models for predicting them. While correlation coefficients may have limitations in isolation, future research may find ways to integrate them with other factors to improve their predictive power. Additionally, advancements in technology and data analytics can offer new insights into market behavior that were previously unavailable.

Moreover, the correlation coefficient has many potential applications beyond stock market analysis. Its utility extends to various fields such as economics, psychology, and social sciences, making it a valuable tool for researchers across disciplines. As more data becomes available and analytical techniques advance, the correlation coefficient's role in understanding relationships between variables is likely to expand further.

Conclusion

While correlation coefficients are a valuable analytical tool in understanding relationships within the stock market, they should not be used in isolation when attempting to predict market success. The limitations highlighted, including their non-causative nature and sensitivity to outliers, emphasize the need for a broader approach that considers various economic indicators, technological advancements, and market sentiment. By incorporating a wide array of factors and utilizing advanced analytical methods, investors and analysts can form a more comprehensive understanding of market dynamics.

Advertisement

Understanding Mortgage Protection Insurance and Its Necessity

Investing in the Pink Market: What You Need to Know About OTC Stocks

Steps to Move a Stock from OTC to a Major Exchange

Medallion Signature Guarantee: An Overview and How to Acquire One

Understanding Refinance Appraisals: A Comprehensive Guide

Navigating the Top 3 Indexes in the U.S. Stock Market

Understanding Owner Financing: A Comprehensive Guide

Demystifying FHA 203(k) Loans: Everything You Need to Know

Qualified Foreign Institutional Investor (QFII): Accessing Global Markets