Convertible ARM Loans Explained: What They Are and How They Work

Sep 28, 2024 By Verna Wesley

Advertisement

Convertible Adjustable Rate Mortgages (ARMs) are a unique type of home loan offering borrowers the flexibility of an initial fixed interest rate with the possibility to convert to a fixed-rate mortgage at a later date. This type of loan is designed to provide the stability of predictable payments for a certain period while capitalizing on potentially lower interest rates of adjustable terms. Homebuyers who anticipate a future rise in interest rates or plan to refinance might find convertible ARMs particularly appealing. Understanding the mechanics of how convertible ARMs operate and the conditions under which the conversion is allowed is vital for borrowers to make informed financial decisions. This guide will explain the intricacies of convertible ARM loans, providing key insights into their benefits and potential drawbacks.

What is a Convertible ARM Loan?

A convertible ARM is a type of hybrid mortgage, blending the features of both adjustable-rate and fixed-rate loans. In essence, it starts with an initial fixed interest rate for a predetermined period before converting to an adjustable rate for the remaining loan term. The conversion feature provides borrowers with an option to change from an adjustable-rate mortgage (ARM) to a fixed-rate one during specific periods.

How Does a Convertible ARM Work?

Convertible ARMs can come in varying terms, but they typically start with a fixed interest rate period ranging from three to ten years. During this time, monthly payments remain constant regardless of any market fluctuations. Once the fixed rate expires, the loan transitions into its adjustable-rate phase, which is usually based on a benchmark index, such as the London Interbank Offered Rate (LIBOR) or the Constant Maturity Treasury (CMT) rate. The interest rate can change periodically after this point, typically every six months or once a year.

Benefits of a Convertible ARM Loan

Flexibility

The primary advantage of convertible ARMs is their flexibility. Borrowers have the option to convert to a fixed-rate mortgage at any time during the predetermined conversion period without having to go through a refinancing process. This allows them to take advantage of potentially lower interest rates while avoiding additional fees and paperwork associated with refinancing.

Lower initial payments

The initial fixed-rate period of a convertible ARM typically comes with lower interest rates compared to traditional fixed-rate mortgages. This allows borrowers to have lower monthly payments, making homeownership more affordable during the early years of the loan.

Protection against rising interest rates

For those who anticipate a rise in interest rates in the future, a convertible ARM can be an attractive option. The conversion feature provides protection against potential rate hikes, offering peace of mind for borrowers who don't want their mortgage payments to fluctuate significantly.

Potential Drawbacks of a Convertible ARM Loan

Uncertainty

One downside of convertible ARMs is that borrowers cannot predict what the adjustable rate will be once the fixed-rate period ends. It is essential to carefully consider the potential risks and have a backup plan in case the interest rate increases significantly.

Limited conversion options

Not all convertible ARMs allow for unlimited conversions to fixed-rate mortgages. Some may only offer one conversion option, while others may have a cap on the number of times a borrower can convert. It's crucial to understand these limitations before choosing a convertible ARM.

Who Should Consider a Convertible ARM Loan?

First-time Homebuyers

First-time homebuyers who are looking to ease into the financial responsibilities of a mortgage may find convertible ARMs attractive. The lower initial payments can help them manage their budget more effectively in the early years of homeownership, providing a cushion as they adjust to new financial commitments.

Homeowners Expecting Rising Interest Rates

Individuals or families expecting a significant increase in interest rates in the future may benefit from the conversion feature of a convertible ARM. This option allows them to lock in a stable fixed rate if market conditions change, protecting against potentially higher payments in the adjustable-rate phase.

Borrowers Planning to Move or Refinance

Borrowers who do not plan on staying in their home for a long period or those intending to refinance before the adjustable-rate period begins may consider this loan option advantageous. The lower initial interest rates and payments can offer cost savings for the duration they plan to retain the mortgage.

Investors and Short-term Homeowners

Real estate investors and individuals purchasing a home as a short-term residence may also benefit from a convertible ARM. The loan's initial lower fixed rates provide the opportunity to reduce expenditures, which can be particularly beneficial when the property is expected to be sold within a few years.

Individuals Seeking Payment Flexibility

Those who desire more financial flexibility may find convertible ARMs appealing due to the option to switch to a fixed-rate loan without refinancing. This can be a strategic choice for borrowers who want to keep their options open while navigating changing interest rate environments.

Steps to Obtain a Convertible ARM Loan

- Assess Your Financial Situation: Before applying for a convertible ARM loan, evaluate your financial health. Consider factors such as your income, expenses, existing debts, and credit score. Understanding your financial position will help you determine if a convertible ARM is the right fit for your needs.

- Research Lenders: Not all lenders offer convertible ARM loans, so it's essential to research various financial institutions. Compare their offerings, interest rates, loan terms, and conversion options. Reading customer reviews and seeking recommendations can also help you find a reputable lender.

- Get Pre-Approved: Contact the lenders on your shortlist to get pre-approved for a convertible ARM loan. During this process, you will need to provide financial documentation, such as pay stubs, tax returns, and bank statements. Getting pre-approved gives you a clear idea of your borrowing capacity and strengthens your position when making an offer on a home.

- Choose the Right Loan Structure: Convertible ARMs come with different initial fixed-rate periods and conversion terms. Work with your lender to select a loan structure that aligns with your financial goals and anticipated changes in your life circumstances. Consider how long you plan to stay in the home and your outlook on interest rates.

- Submit a Loan Application: Once you've selected a lender and determined the loan structure, proceed to complete the loan application process. This includes submitting all necessary documentation and undergoing a credit check. The lender will review your application, and if approved, will provide a Loan Estimate that outlines the terms and costs associated with the loan.

- Home Appraisal and Inspection: Your lender will order an appraisal to determine the market value of the property you intend to purchase. An inspection may also be required to ensure the home is in good condition. Both steps are crucial to securing final loan approval.

- Review and Sign Closing Documents: Once your loan is approved, you will receive a Closing Disclosure detailing the final terms and costs associated with the loan. It is crucial to review this document thoroughly and discuss any discrepancies with your lender. After all terms are agreed upon, you will participate in a closing meeting to sign the official loan documents.

- Begin Making Payments: After closing, your convertible ARM loan is active, and you begin making monthly mortgage payments. Initially, your payments will be based on the fixed interest rate period. Be mindful of the conversion terms and stay informed about your loan status to make timely decisions if you choose to convert to a fixed-rate mortgage in the future.

Conclusion

Convertible ARMs can be a flexible and cost-effective mortgage option for certain borrowers. By offering the security of a fixed rate initially and the option to convert to a fixed-rate mortgage later, they address the needs of individuals and families with varying financial situations and future plans. However, it is crucial to thoroughly understand the terms and limitations associated with this type of loan. Carefully assess your financial health, research potential lenders, and stay informed about interest rate trends to make the most of a convertible ARM. With diligent planning and consideration, a convertible ARM can be a valuable tool in achieving your homeownership goals.

Advertisement

The Evolution of the São Paulo Stock Exchange: From Inception to Present

Pacific Exchange (PCX): Defining Its Purpose and Impact

Demystifying FHA 203(k) Loans: Everything You Need to Know

OTCEI Explained: Features, Requirements, and Market Dynamics

The Canadian Securities Exchange Explained: What You Need to Know

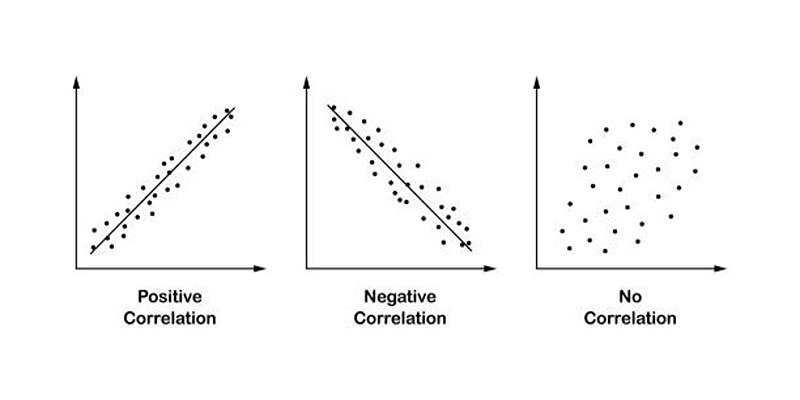

Can the Correlation Coefficient Really Predict Stock Market Success?

Demystifying Market Capitalization: The Role of Free-Float Methodology

Exploring the Order Audit Trail System: A Beginner's Guide

What to Do When Your Mortgage is Sold: A Homeowner's Guide